Your Child Will Inherit at 18 by Default. Here’s How to Change That.

If you have children under 18 and you’re making a Will, you will almost certainly need a trust for children.

What most parents don’t realise is that the law already has a default trust structure. And if you don’t actively choose something different, that default applies whether you like it or not.

The two most common trusts for children in UK Wills are:

Bereaved Minors Trusts (BMTs)

Age 18–25 Trusts

They sound similar, but they are used in very different situations and lead to very different outcomes.

What is a Bereaved Minors Trust?

A Bereaved Minors Trust is a statutory trust created automatically when a parent dies leaving assets to a child under the age of 18.

Importantly, this trust arises by default.

If a parent dies:

• without a Will (intestacy), or

• with a Will that leaves assets to their children outright

The law imposes a Bereaved Minors Trust automatically.

“You don’t have to ask for it. You don’t have to choose it. It just happens, whether you have a Will or not.”

How a Bereaved Minors Trust works

Until the child turns 18:

trustees hold and manage the inheritance

income belongs to the child

money can be used for the child’s maintenance, education and benefit

When the child turns 18:

the trust must end

the child becomes absolutely entitled to their share

trustees have no power to delay this

This applies even if the parents would have preferred a later age.

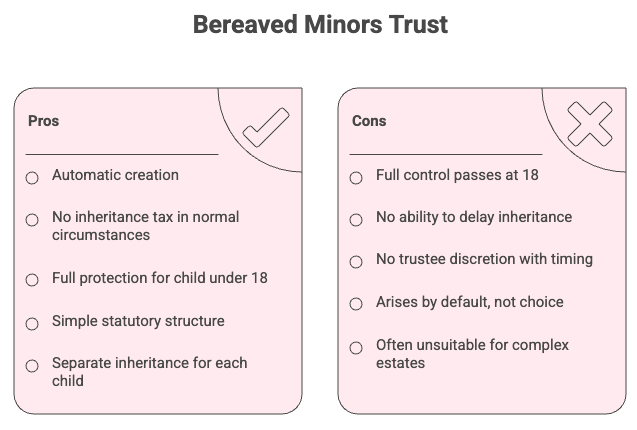

Cons of a Bereaved Minors Trust

Full control passes at 18, with no flexibility and for many families, that is simply too young.

What is an Age 18–25 Trust?

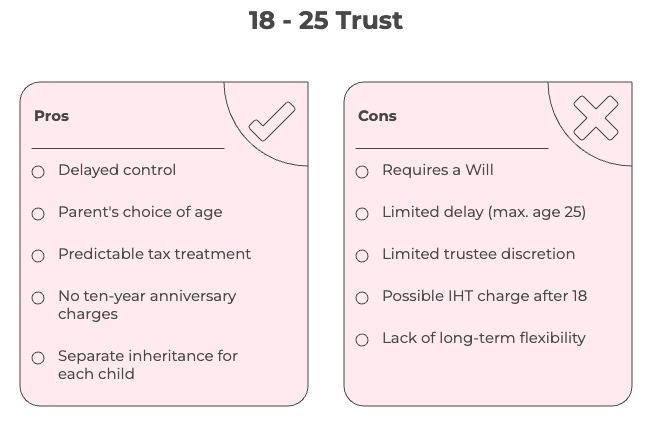

An Age 18–25 Trust exists specifically to delay inheritance beyond age 18.

It allows a parent to say:

“My child should inherit later than 18, but no later than 25.”

Unlike a Bereaved Minors Trust, an age 18–25 trust cannot arise automatically.

It only exists if:

there is a Will, and

the Will explicitly states an age over 18 (up to a maximum of 25).

If there is no Will, or no age is specified, the trust defaults back to a Bereaved Minors Trust ending at 18.

How an Age 18–25 Trust works in practice

From the parent’s death until the child reaches the age specified in the Will:

the trust holds the inheritance

the child is entitled to all income

any money used must be for that child only

When does the child actually receive the inheritance?

This depends entirely on the age written into the Will.

If the Will says 21, trustees cannot release the capital earlier

If the Will says 25, trustees must hold until 25

If the Will allows trustees discretion between 18 and 25, they may choose when

Trustees cannot override the Will. They are bound by the parent’s instructions.

“The law requires that the child must become absolutely entitled by age 25 at the latest. That upper limit is imposed by statute and an older age cannot be specified in the Will.”

What if you have more than one child?

With both Bereaved Minors Trusts and Age 18–25 Trusts:

each child is treated separately

each child has their own entitlement age

This means:

the eldest child receives their share first

the trust continues only for the younger children

the trust reduces over time as each child reaches their age

There is no requirement for all children to inherit at the same time.

Inheritance tax and children’s trusts

Bereaved Minors Trust and inheritance tax

There is no inheritance tax charge if:

the child inherits at 18, or

funds are used for the child’s benefit, or

the child dies before reaching 18

Age 18–25 Trust and inheritance tax

If the child inherits:

between 18 and the age stated in the Will (up to 25) → a limited inheritance tax charge applies

This charge is:

proportionate

capped

free from ten-year anniversary charges

In short, delaying inheritance beyond 18 comes with a known and controlled tax cost, not an open-ended one.

The biggest mistake parents make

Many parents assume that:

trusts automatically delay inheritance to 21 or 25, or

trustees can always decide when a child inherits

Neither is true. If you do nothing:

the law defaults to 18

If you want a later age:

it must be deliberately written into the Will

Final thoughts

“Bereaved Minors Trusts protect children by default. Age 18–25 Trusts protect children by intention.

The difference is planning.

At AWAY Wills, we don’t rely on statutory fallbacks. We help parents actively choose the right trust structure for their children, their values and their long-term plans.

Because when it comes to inheritance, timing matters just as much as the money.”